How to Leverage Profit First for Your Short-Term Rental Business

This post is written by By Lindsey Stefanka* and sponsored by Relay. Relay’s online banking and money management platform puts you in complete control of your cash flow.

As a short-term rental host, you have a lot of expenses to cover. From utilities to cleaning and restocking household essentials, making a profit isn’t always easy. But with Profit First, you can make your short-term rentals more profitable by paying out your profit before expenses.

In this guide, we’ll discuss:

- What Is Profit First?

- Why Short-Term Rental Businesses Should Use Profit First

- The Profit First Accounts Short-Term Rental Hosts Need

- How Relay Can Help You Set Up Profit First

- Take Your Profitability a Step Further: Enter to Win $50,000

If you’re curious about how to use the Profit First method to become more profitable, here are the ins and outs of Profit First for managing your short-term rental finances.

What Is Profit First?

Profit First is all about, well, putting your profit first. It’s a cash flow methodology that prioritizes profit over business expenses (like the cost of turnovers and utilities) so that your short-term rentals are profitable from day one.

As a short-term rental host, you likely pay your operating expenses from your revenue and what’s left is your profit (revenue – expenses = profit). But that doesn’t have to be the case!

Profit First makes your rentals more profitable by taking out your profit before your expenses (revenue – profit = expenses). After all, you’re running a business and the goal is to make it as profitable as possible.

The concept is rooted in Parkinson’s Law, where work expands to fill the time allotted. In this case, your expenses expand to use all, or most, of your revenue. For short-term rental owners, using the Profit First method allows you to take your profit percentage out of your revenue before your expenses. But how beneficial is this cash flow method for short-term rentals?

Why Short-Term Rental Businesses Should Use Profit First

Short-term rentals are a great way to bring in extra cash, but that money doesn’t always find its way into your wallet. That’s where Profit First comes in.

The Profit First method was originally coined by entrepreneur Mike Michalowicz and used for a range of business types, but it wasn’t until David Richter wrote Profit First for Real Estate Investing that it gained popularity in the real estate community.

Since its publication, countless real estate businesses have used this method to increase their profitability. But it’s specifically helpful for short-term rentals because expenses can be high.

For example, a typical month of expenses might consist of turnover cleaning, utilities, and restocking household essentials among others. But what happens when damage occurs? When you have to replace a dishwasher or repair roofing? These are variables that change from month to month and can eat away at your profit margins.

And growing your short-term rental business poses its own set of challenges. You need enough cash on hand to invest in additional properties, but where exactly does that come from?

With Profit First, you can become more profitable quicker which allows you to expand your business and have a crystal clear view of how much is left for business expenses and investments. No more cash flow issues looming around the corner!

The Profit First Accounts Short-Term Rental Hosts Need

There are five traditional checking accounts recommended for Profit First. These include:

- Revenue: The main checking account where your total revenue from rentals will live.

- Profit: Where you’ll transfer your profit each month.

- Tax: Where you’ll keep taxes to be paid out quarterly or at year-end.

- Owner’s Pay: Where you’ll keep profit to be paid to yourself.

- Operating Expenses: Where you’ll keep the cash needed to run your business.

Basically, your cash will flow from your Revenue account to your Profit, Tax, Owner’s Pay, and Operating Expenses accounts. Here’s how much cash flow you should allocate to each of these checking accounts.

Profit First Cash Flow Percentages

This chart breaks down what your Target Allocation Percentages (TAPs) should be based on your business’ Real Revenue, otherwise known as your Current Allocation Percentages (CAPs).

For example, if you make $50,000 in revenue from your rentals, $50,000 will be deposited into your Revenue account. From there, $2,500 will be transferred to your Profit account, $25,000 to Owner’s Pay, $7,500 to Tax, and $15,000 to Operating Expenses.

The issue is that many banks charge you extra to open additional accounts and have minimum balance requirements. These fees can eat away at your profits, making it essential to find the right bank to implement Profit First.

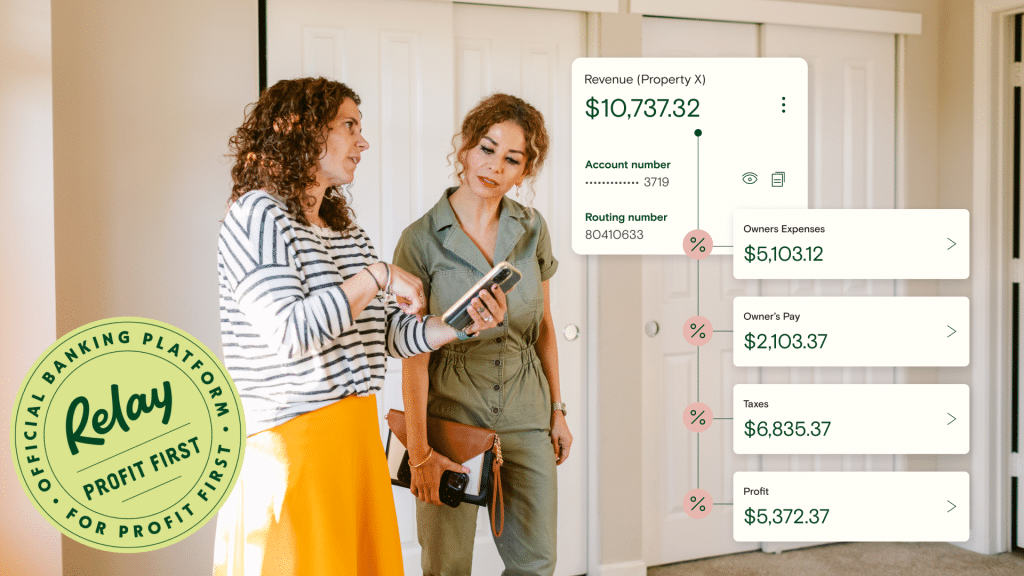

How Relay Can Help You Set Up Profit First

At a minimum, you need a bank that allows you to open multiple checking accounts and offers percentage-based transfers to implement the Profit First method. However, being able to have multiple LLCs under one login and no minimum balance requirements can take your cash flow clarity to the next level.

This is what makes Relay a great option for Profit First banking. Relay is the official banking platform for Profit First, which means it’s recommended by Mike Michalowicz, creator of Profit First. With Relay, you can:

- Open up to 20 free checking accounts: To implement Profit First, you’ll need to set up five different checking accounts to categorize your cash flow. Relay gives you up to 20 free checking accounts with no fees or minimum balances, allowing you to set up accounts for each of your properties. You can also assign a name for each account in Relay. In this case, you’ll name them Revenue, Profit, Owner’s Pay, Tax, and Operating Expenses.

- Automate percentage-based transfers: Since Profit First uses percentages to calculate how much cash to deposit into each account, having automatic transfer rules can make implementation super simple. With Relay, you can create transfer rules to automatically allocate money from Revenue to your other accounts.

- Organize multiple LLCs under one login: If your rental properties are under separate legal entities, it can make banking chaotic. But with Relay, you can organize multiple LLCs under one login for greater visibility into your profitability across all your rentals.

Relay doesn’t charge account fees or minimum balances so you don’t have to worry about your cash getting tied up. Plus, you can assign spending limits on up to 50 physical or virtual debit cards for ultra-rich transaction data.

If you’re ready to become more profitable, you can open a free Relay account in just a few minutes today!

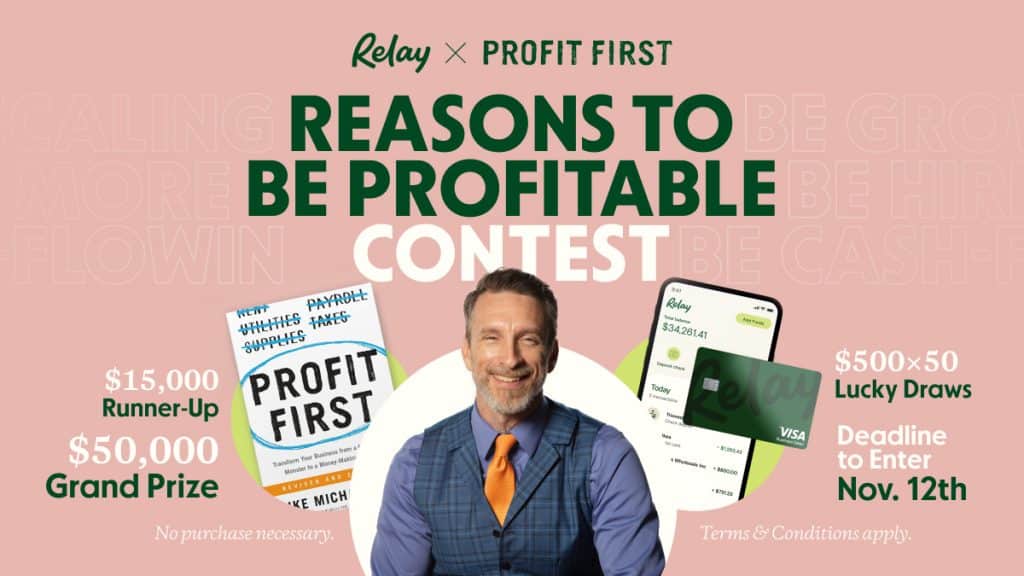

Take Your Profitability a Step Further: Enter to Win $50,000

Want to take your profitability a step further? Enter Relay’s Reasons to Be Profitable Contest for a chance to win $50,000! They want to hear why you’re putting profit first, reward you for it, and bring you closer to making that why a reality. 53 lucky business owners will win a cash prize and additional goodies to help you dive deeper into the world of profitability.

Share your story and enter to win the grand prize by November 12, 2023.

Relay is a financial technology company, not an FDIC-insured bank. Banking services and FDIC insurance are provided through Thread Bank and Evolve Bank & Trust; Members FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

The interest rates and annual percentage yield on your account are accurate as of 05/16/23 and are variable and subject to change based on the target range of the Federal Funds rate. APY will vary between 1-3% depending on the balances held. Earn 1% APY on savings balances of less than $50,000, 1.5% APY on savings between $50,000 and $250,000, 2% APY on savings balances between $250,000 and $1,000,000 and 3% APY on savings balances of more than $1,000,000. There are no minimum balances or minimum deposits required to earn interest on your account.

*Lindsey Stefanka is a freelance writer, content strategist, and business owner. She strives to empower other entrepreneurs by writing content that educates and inspires. When she isn’t writing for Relay, Lindsey also covers marketing, business, and lifestyle content for a variety of publications.

About the Author Beth McGee

Beth McGee is an Airbnb Superhost and a home cleaning and organization expert. Beth enjoys helping hosts succeed in the short-term rental industry through virtual services such as listing setup, guest relations, and creating an excellent guest experience. She is the author of Get Your House Clean Now: The Home Cleaning Method Anyone Can Master, a best-selling book that has helped thousands of readers improve their well-being and STR experience by transforming their homes into spaces of comfort and cleanliness.

Related

5 Reasons Why You Should Install Privacy-Safe Noise Monitors in Your Short-Term Rental Properties

How To Start An Airbnb Business

How To Gain a Competitive Edge & Thrive in Your Evolving Vacation Rental Market

How to Manage Short-term Rental Finances Using Baselane Banking

OwnerRez: Empowering Vacation Rental Owners with Software Solutions

Elevate Your Vacation Rental with AI: A Quick Guide for Hosts

7 Time-Saving Hacks Hiding Inside a Digital Guest Welcome Book

5 Tips on Hosting a Kid-Friendly Airbnb